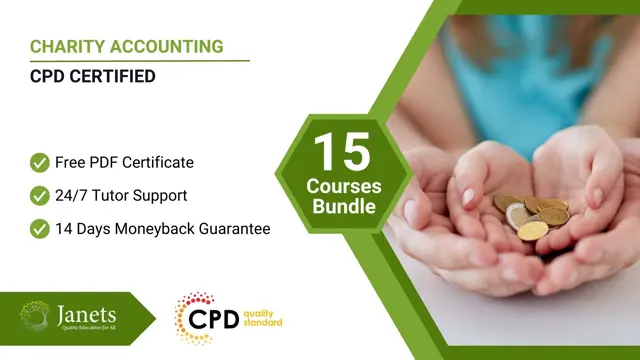

Charity Accounting - CPD Accredited Training

All-in-One 15 CPD Courses Bundle | 150 CPD Points | Free PDF & Hardcopy Certificate | Tutor Support | Lifetime Access

Janets

Summary

- CPD Accredited PDF Certificate - Free

- CPD Accredited Hard Copy Certificate - £15.99

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

Picture this: the relentless pursuit of a noble cause, a dedication to making the world a better place, yet constantly mired in the complexities of charity accounting. The pain is palpable, and the frustration is often overwhelming. But in the grand tapestry of philanthropy, the role of Charity Accounting is absolutely pivotal. It's the bridge between vision and impact, ensuring every precious penny is meticulously allocated to where it's needed most. Understanding the nuances of Charity Accounting isn't merely a choice—it's a moral obligation to uphold the integrity of your mission.

In our 15-course Charity Accounting bundle, we will take you through an enlightening journey to master the art of financial stewardship for charitable organisations. You will learn the ins and outs of Charity Accounting, delve into managerial and tax accounting, and grasp the intricacies of financial analysis and corporate finance. Unlock the secrets of effective financial investigation and anti-money laundering practices. Dive into pension and payroll management, understand the complexities of VAT, and explore the world of UK insurance.

With this comprehensive Charity Accounting bundle, you'll be equipped to navigate the intricate financial terrain of the charitable sector, making your mission not just impactful but financially astute. Don't let frustration hold you back any longer. Join us on this journey and take the first step towards elevating your charity's financial integrity. Enrol now and make a difference that truly counts!

Learning Outcome

By the end of this Charity Accounting course, you will be able to:

- Acquire a foundational understanding of accounting principles.

- Gain expertise in managerial accounting, focusing on financial decision-making for charities.

- Learn to use Xero Accounting and Bookkeeping for efficient financial management in the charity sector.

- Understand pension fund management for charity employees and stakeholders.

- Conduct financial analysis to evaluate and improve charity financial performance.

- Learn the basics of corporate finance to make informed financial decisions in charity management.

- Become a financial investigator to uncover fraud and financial irregularities in charity organisations.

- Develop the skills of an investment analyst to manage charity investments and portfolios.

- Understand the implications of value-added tax (VAT) in charity accounting and compliance.

What You Get Out Of Studying With Janets

- Free PDF certificates upon successful completion of the Charity Accounting bundle

- Lifetime access to Charity Accounting bundle course materials

- Instant assessment results

- Full tutor support is available from Monday to Friday with this Charity Accounting bundle.

- Study the Charity Accounting bundle at your own pace

- Accessible, informative modules taught by expert instructors

- Get 24/7 help or advice from our email and live chat teams with the Charity Accounting bundle

- Study the Charity Accounting bundle at your own time through your computer, tablet or mobile device

CPD

Course media

Description

Our all-encompassing 15-course Charity Accounting Bundle is designed to equip learners with a comprehensive skill set tailored to the intricacies of accounting within the charitable sector. From mastering the fundamentals of charity accounting and general accounting principles to delving deep into managerial accounting, tax accounting, and financial analysis, this program provides a robust foundation in accounting and finance. Learners will gain hands-on experience in Xero accounting and bookkeeping, payroll management, pension accounting, and the complexities of VAT.

Moreover, this Charity Accounting Bundle explores niche areas such as financial investigation, investment analysis, and anti-money laundering practices to ensure a well-rounded understanding of financial management. Completing the Charity Accounting Bundle with an introduction to UK insurance, you will emerge well-prepared to navigate the unique challenges and opportunities within charity accounting, making it a valuable asset for those seeking to excel in the non-profit sector or financial services industry.

The Charity Accounting - CPD Accredited Training Bundle comes with one of our best-selling Charity Accounting courses with a FREE CPD Certified Hardcopy certificate along with 14 additional CPD Certified courses:

- Course 01: Accounting

- Course 02: Managerial Accounting

- Course 03: Xero Accounting and Bookkeeping Training

- Course 04: Accounting and Finance

- Course 05: Tax Accounting

- Course 06: Payroll Management

- Course 07: Pension

- Course 08: Financial Analysis

- Course 09: Basics of Corporate Finance Training

- Course 10: Financial Investigator

- Course 11: Investment Analyst

- Course 12: Anti-Money Laundering (AML) Training

- Course 13: Introduction to VAT

- Course 14: UK Insurance Complete Course

Method of Assessment

To successfully complete the Charity Accounting Bundle, students will have to take automated multiple-choice exams for each course. These exams will be online, and you will need to score 60% or above to pass the courses.

After successfully passing the course exams, you will be able to apply for the certificates as proof of your expertise.

Who is this course for?

This Charity Accounting bundle is for:

- Individuals interested in working in finance and accounting roles within the charity sector.

- Charity workers looking to enhance their financial management and accounting skills.

- Nonprofit organisation leaders and managers aiming to improve financial decision-making.

- Compliance officers and auditors focused on ensuring financial legality in charities.

- Anyone with a passion for supporting charitable causes through financial expertise.

Requirements

No prior qualifications are needed for learners to enrol on this Charity Accounting Bundle.

Career path

Here are a few careers you can opt for after completing the Charity Accounting bundle:

- Charity Accountant: £25,000 - £45,000

- Financial Analyst: £25,000 - £50,000

- Finance Manager for Nonprofits: £30,000 - £55,000

- Compliance Officer: £25,000 - £45,000

- Auditor for Charities: £25,000 - £50,000

- Investment Analyst: £30,000 - £60,000

- Anti-Money Laundering (AML) Specialist: £25,000 - £50,000

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Certificates

CPD Accredited PDF Certificate

Digital certificate - Included

CPD Accredited Hard Copy Certificate

Hard copy certificate - £15.99

A physical, high-quality copy of your certificate will be printed and mailed to you for only £15.99.

For students within the United Kingdom, there will be no additional charge for postage and packaging. For students outside the United Kingdom, there will be an additional £10 fee for international shipping.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.